Dispensing medicines continues to be at the core of community pharmacy practice, with most medicines dispensed through community pharmacy being done under the Pharmaceutical Benefits Scheme (PBS).

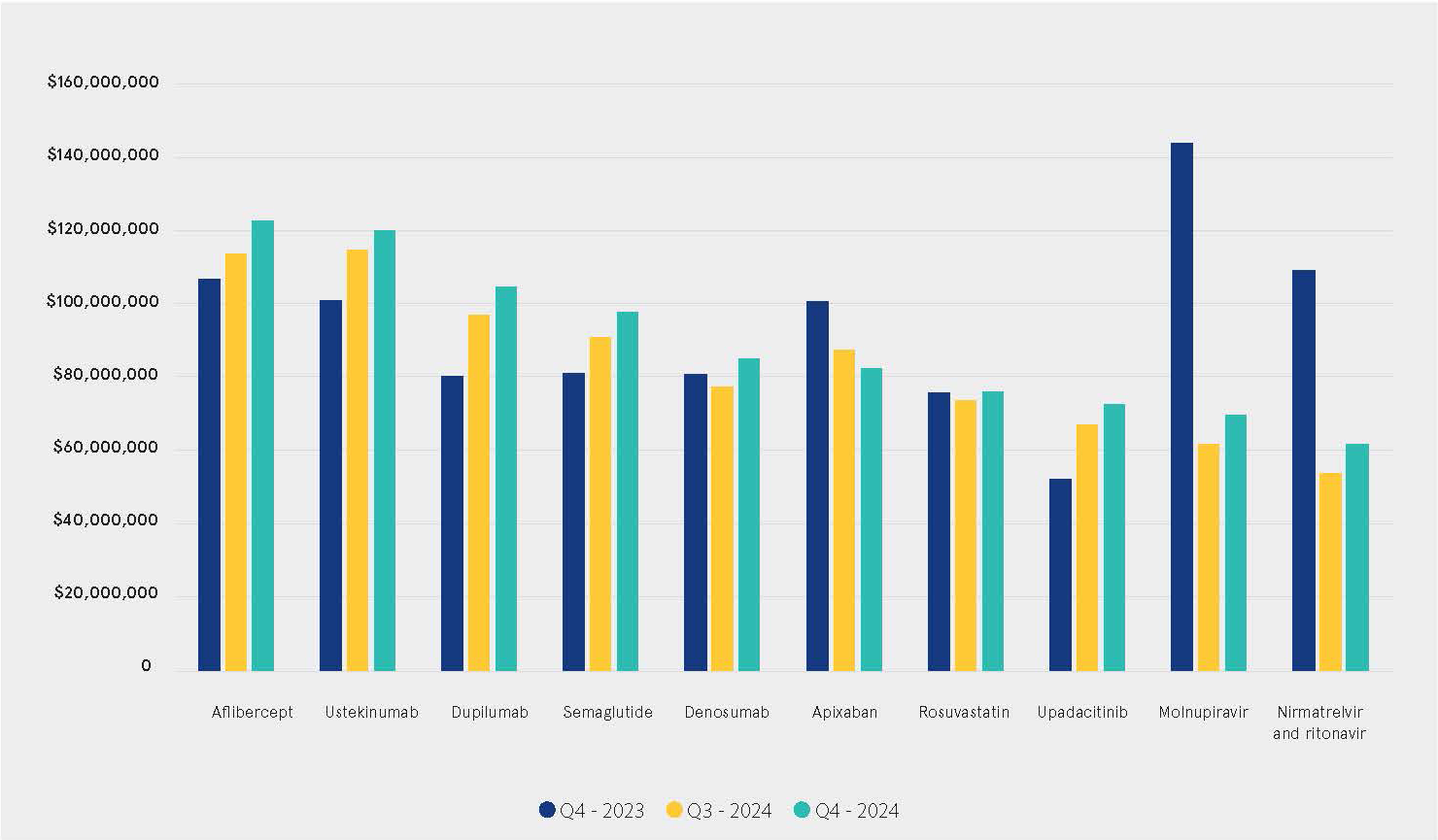

While the highest volume drugs that are supplied under the PBS continue to be older molecules such as statins, antibiotics and medicines used to treat hypertension, an increasing trend is seen across the past few years for the highest total expenditure to be on biologics such as Eylea® (aflibercept) used to treat macular degeneration, Stelara® (ustekinumab) used in the treatment of a number of autoimmune diseases, and notably, Ozempic® (semaglutide) which is used to lower blood glucose, but increasingly used in addition for weight management. On the other end of the spectrum, the volume of anti-viral medications used to treat COVID-19 has been rapidly declining as the impact of the pandemic diminishes.

The top types of conditions for which PBS medicines were dispensed were related to the cardiovascular system (31%), with antidepressants coming second (23%). The third highest class of medicines supplied under the PBS was for gastrointestinal conditions and chronic metabolic diseases such as diabetes (16%). This was a trend consistent with previous years.

Impact of longer scripts

The impact of 60-day dispensing was seen on script volumes with Q4 2024 volumes being slightly lower than the same quarter in the previous year by around 500,000 scripts, though the impact continues to be lower than anticipated (approximately 20% of eligible scripts are dispensed as 60-days, versus a government projection of 58% for FY2025). There has been some impact on the mix between PBS-subsidised and nonsubsidised scripts due to the increase in dispensed prices for 60-day medicines, however this was minor when compared to the same quarter in the previous year and mainly reflected the increasing rate of medicines that are claimed as PBS-subsidised due to patients reaching the Safety Net across the course of the year.

Top PBS medicines by expenditure

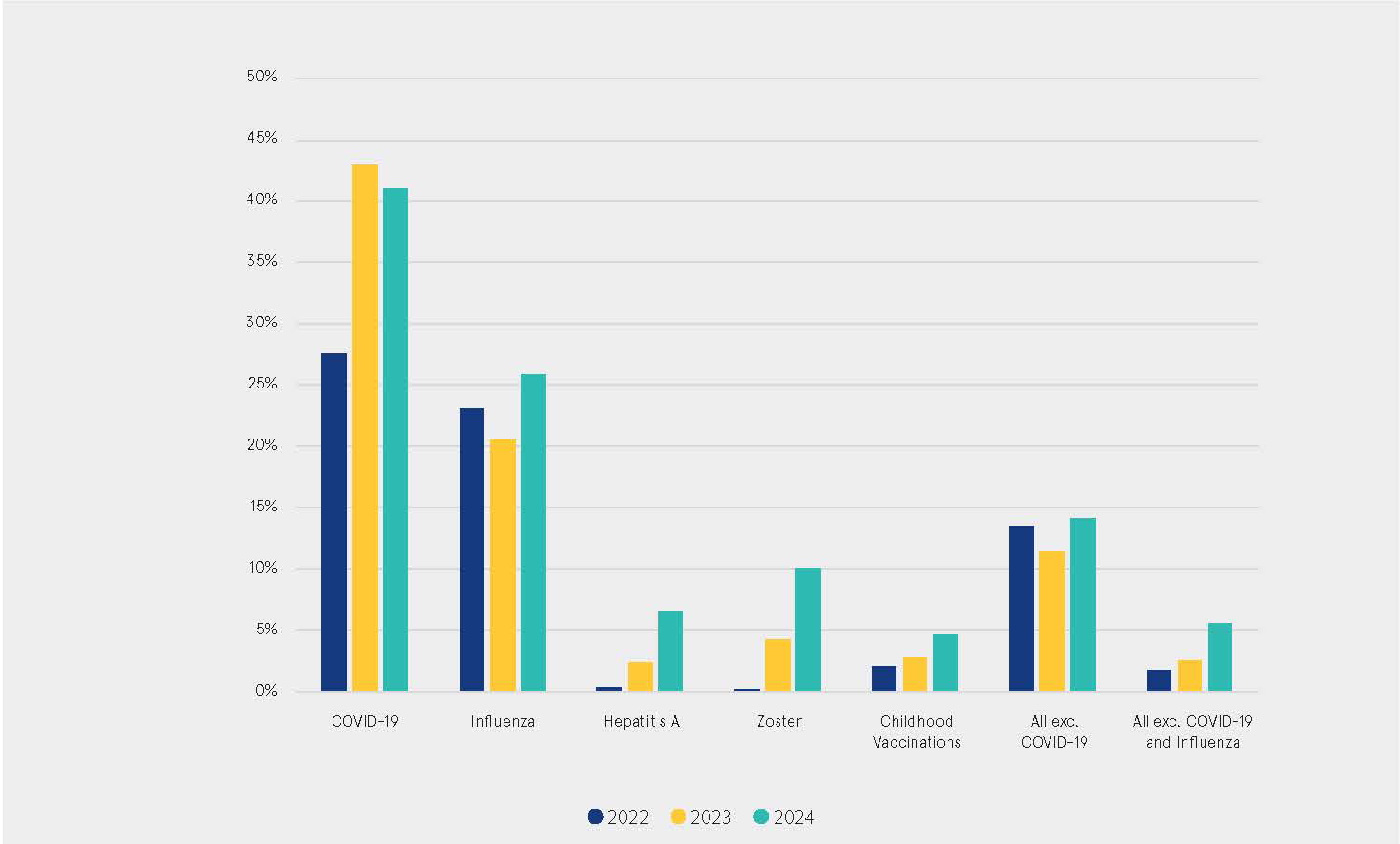

Pharmacy market share by vaccine category & year

Eighth Community Pharmacy Agreement Dose Administration Aids

Focus on service offerings

With pharmacies increasingly turning their focus to health service offerings through greater recognition of full scope of practice, the share of vaccinations being given to Australian patients through community pharmacy has been rising, demonstrating the acceptance of patients to receive their care in the most accessible healthcare location. A strong increase in influenza vaccinations occurred, which saw 25% of all influenza vaccinations given to Australians provided through community pharmacies in 2024. This was up from 20% in 2023 and supported by the participation of community pharmacy in free flu vaccination programs offered in some states during the year. A reduction in the proportion given by GPs was seen (54% down from 60%), showing more patients choosing community pharmacy as their vaccination providers of choice.

COVID-19 vaccination rates remained strong, with over 40% being provided through community pharmacy during the year. Work by State and Territory Governments to increase the range of patients that can be vaccinated in pharmacy also drove an increase in childhood vaccinations, with 5% of all childhood vaccinations given in pharmacy during 2024, up from 2% in 2022. This is a service that we expect to continue to develop as patient awareness and confidence in pharmacists as primary health care providers grows.

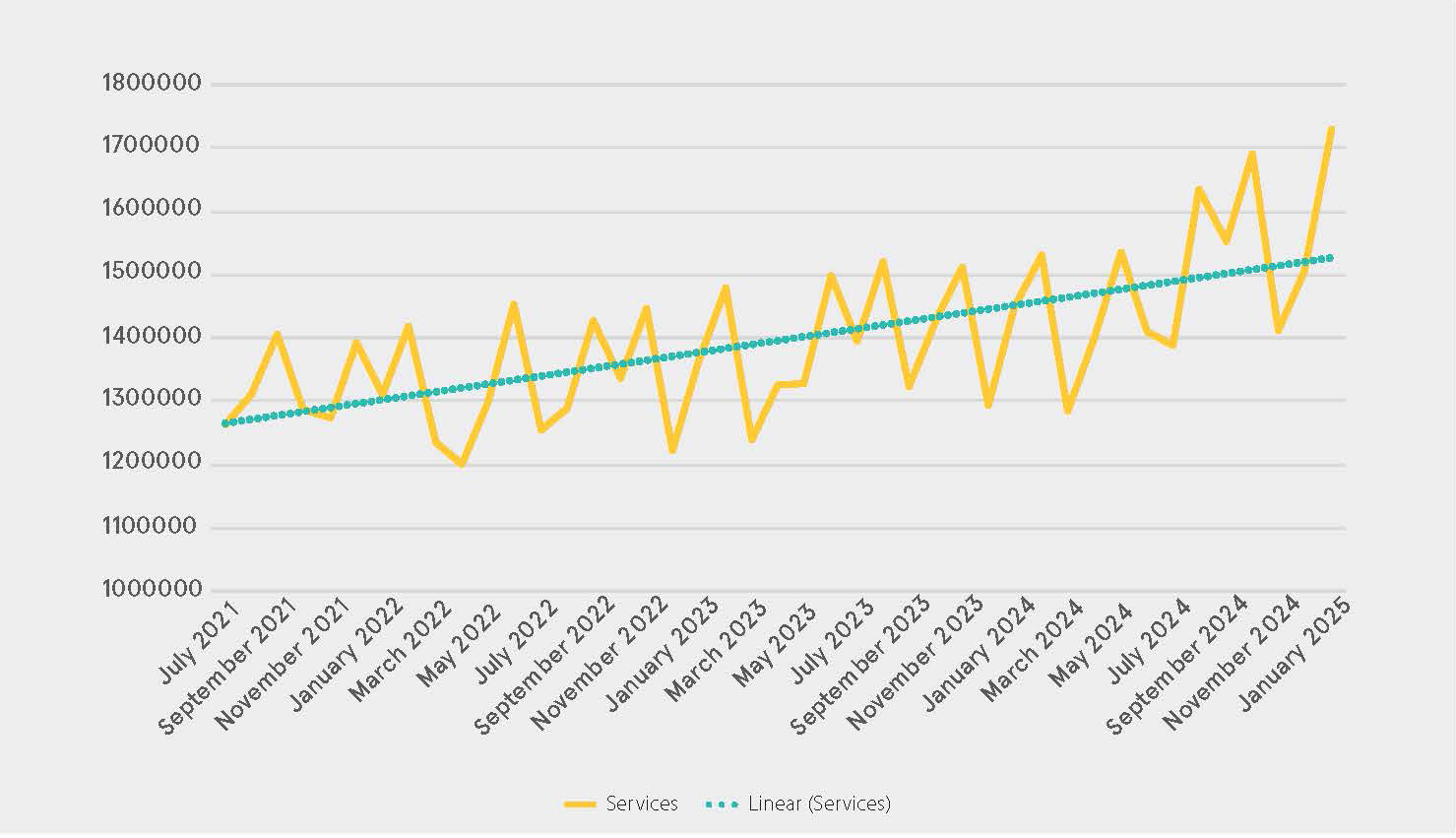

The focus on health service growth was also seen in the number of services delivered under 8CPA programs. Patient demand for these services continued to increase, driven by the change in the weekly Dose Administration Aid program base cap from 60 to 90 per week, meaning patients who were previously unable to access funding for this program due to caps were able to receive much needed cost-of-living relief through Government subsidies towards the cost of this service.

At a broader economic level, growth slightly above core inflation was seen in retail turnover (3.6%) and even more so in pharmaceutical turnover (11.3%), which includes all components of the pharmaceutical supply chain including medicines. Meanwhile, core inflation fell from 3.3% to 2.9%, based on the trimmed mean Consumer Price Index for March 2025. This puts core inflation back in the Reserve Bank of Australia’s target band, in promising signs for the Australian economy.